Green budgeting

Green budgeting records and analyzes, the climate-specific and environment-specific positive, neutral and negative impacts of all budgetary, regulatory and tax policy measures and processes within the public sector. This analysis covers both the financial aspects (input consideration) and the assessment of the impact dimension (impact consideration) and provides a decision-making basis for contributions to compliance with national and international climate-related and environmental goals.

In the interests of making the best possible use of tax revenues, green budgeting is intended to support the greatest possible impact per Euro invested.

Integration of Federal budget and climate-and environmental goals

A development of Austria that is resilient to the consequences of anthropogenic climate change, low-carbon and environmentally friendly involves a development that meets the needs of the present generation without endangering the resources of future generations. In this context, the matter of an efficient and effective climate change mitigation and environment preservation system is inseparably linked with the aim of sustainably managed budgets.

This trend of linking budgetary funds and climate and environment preservation measures is gaining prominence at both an international and national level, under the term "green budgeting". Both the European Commission (EC) and the Organisation for Economic Co-operation and Development (OECD) have adopted this practice

Green budgeting in the Federal Ministry of Finance

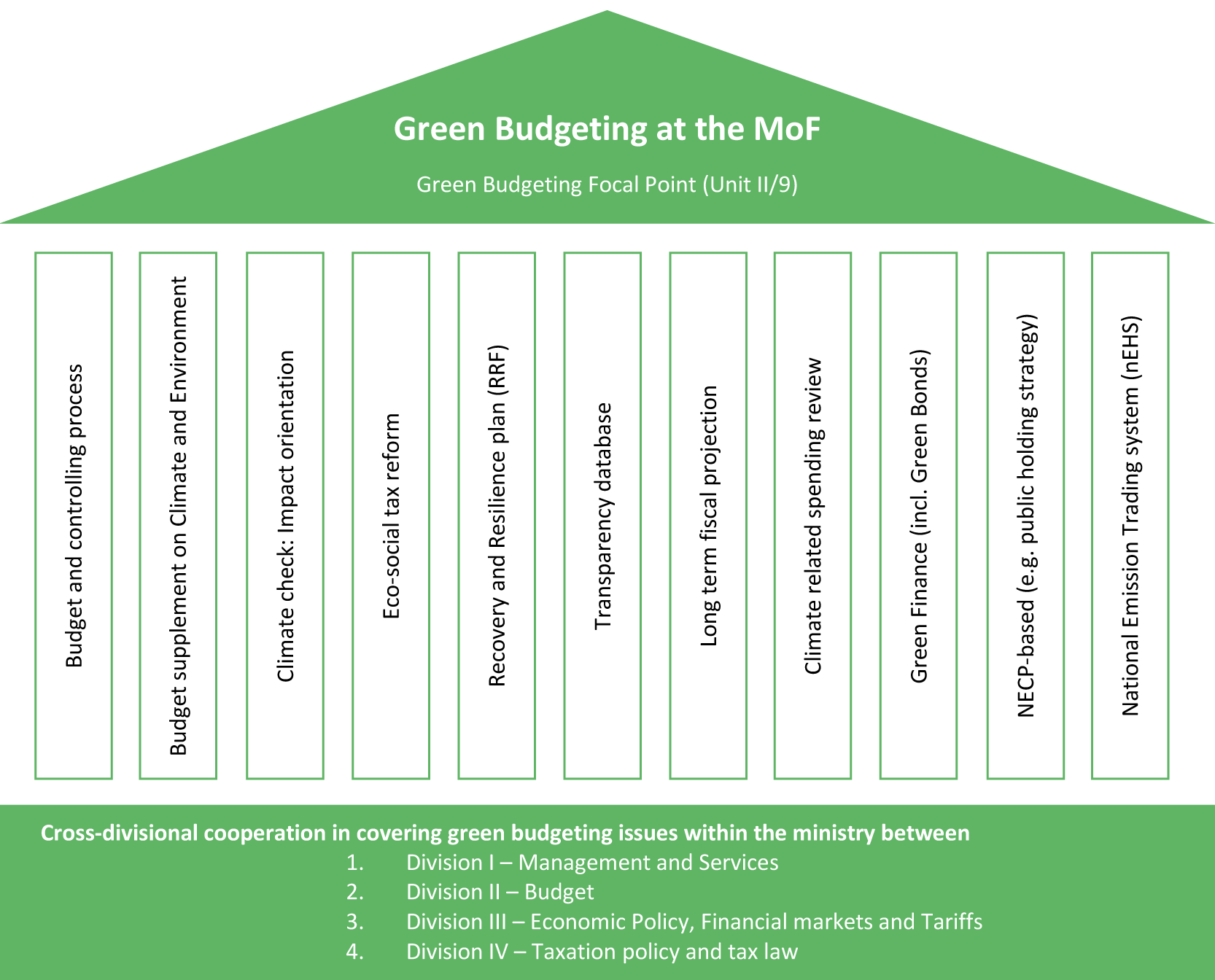

The implementation of green budgeting implies the involvement of numerous areas within the Federal Ministry of Finance. The following figure illustrates the green budgeting instruments applied in the Federal Ministry of Finance.

It is important to note that all the "green budgeting components" are not only purely oriented to the financial perspective (input perspective), but that this financial perspective is also supplemented by the impact dimension (impact perspective). Due to its impact indicators, the transparency database (TDB) of the Federal Ministry of Finance serves as a tool for linking the input perspective with the impact perspective.

Range of activities in the field of green budgeting

The implementation and iterative application of green budgeting instruments in the federal budget is carried out procedurally in multiple phases.

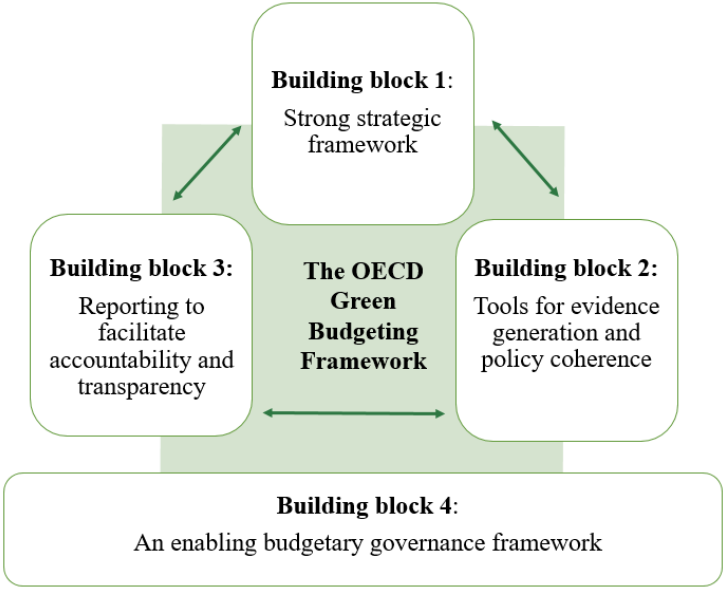

A framework on green budgeting developed by the OECD maps the entire scope of green budgeting processes in a structured fashion and clarifies their integration in numerous fields of activity of the Federal Ministry of Finance. It comprises four components, as shown in the following figure: i) Strategic planning, ii) Evidence generation and policy coherence, iii) Accountability and transparency and iv) a framework for budgetary governance.

Building on the framework of the OECD, a complementary framework of the EC outlines an approach to the national implementation of green budgeting based on five key elements:

i) The scope in terms of the coverage of environmental objectives, budgetary items and public sector entities,

ii) The methodology used for assessing consistency of budgetary policies with environmental goals,

iii) The results,

iv) The governance in the sense of determining the responsibilities for each participant, and

v) The transparency and accountability of the process.

Responsibility

In accordance with the recommendation of the European Commissiona green budgeting focal point has been established in Department II/9 of the budgetary section of the Federal Ministry of Finance. With the aim of improving the consideration of ecological aspects in the budgetary process, the green budgeting focal point serves as an inter-institutional point of contact and an internal point of coordination for green budgeting activities.

Related links

Initial information on the 2022 national commercial law on emissions certificates (NEHG 2022)