Record keeping, transmission and retention obligations for payment service providers - Central Electronic System of Payment Information (CESOP)

In 2020, the Member States of the European Union adopted a legislative package to monitor certain cross-border payments made by payment service providers to combat VAT fraud. Member States forward the records transmitted by the payment service providers to the European Commission's Central Electronic System of Payment information (CESOP), where this data will be stored, aggregated and cross-checked with other European databases. Eurofisc liaison officers of the Member States will have access to this data to combat VAT fraud.

In line with Regulation (EU) 2016/679 of the European Parliament and of the Council (General Data Protection Regulation), it is important that the obligation for payment service providers to store and provide information on cross-border payments is proportionate and limited to what Member States need to combat VAT fraud. Therefore, the only information relating to the payer that is stored should be the payer's location - i.e. its Member State. As far as the payee and the payment itself are concerned, only economic activities are to be recorded. For this purpose, data will only be transmitted if the payee receives more than 25 cross-border payments within a calendar quarter.

The transposition of the EU legislation into national law must be completed by December 31st, 2023. The provisions enter into force on January 1st, 2024. The first notification by payment service providers to the CESOP portal must be made by April 30th, 2024 and include records relating to the first quarter of 2024.

Reporting periods for payment service providers (§ 18a Abs. 8 Z 2 UStG 1994):

- 1st period (January to March): April 30th

- 2nd period (April to Junr): July 31st

- 3rd period (July to September): October 31st

- 4th period (October to December): January 31st

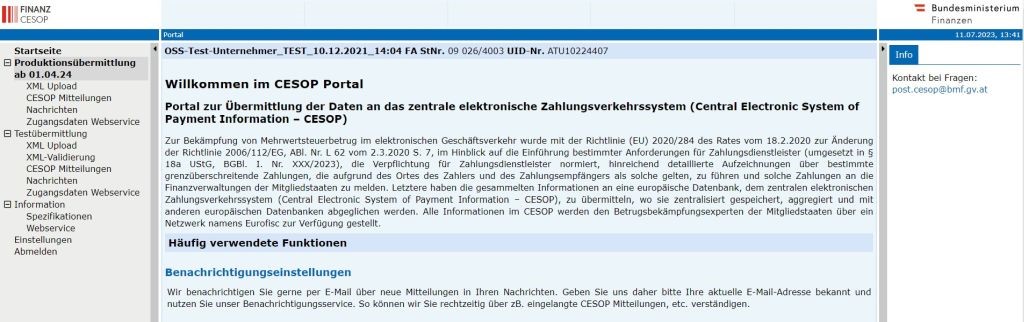

CESOP Portal

Access

Access to the CESOP portal is via FinanzOnline (select "CESOP" on the right-hand side under „Mit FinanzOnline zu folgenden Verfahren“)

Advice

Payment service providers that are not established in Austria can register using online identification. Online identification is also available in English.

The CESOP portal will be available for transmissions from April 1st, 2024.

The test environment is expected to be available for XML validation and testing with the CESOP test environment from October 4th, 2023

CESOP Messages

"CESOP messages" are available in the CESOP portal for both test and production environment. Transmissions that have already been made can be searched for and managed there.

CESOP Notifications

The "CESOP News" area is available for both the test and production environment. CESOP portal notifications (transmission protocols, reminders, etc.) can be searched for and managed there.

Upload of payment data

The XML upload of payment data is available for testing and in production. You can use this function to upload and submit your payment data as an XML document via file upload. The uploaded payment data is then validated and transmitted to CESOP. The result of the validation will be sent to you as a CESOP validation notification. You will be notified by portal notification or e-mail.

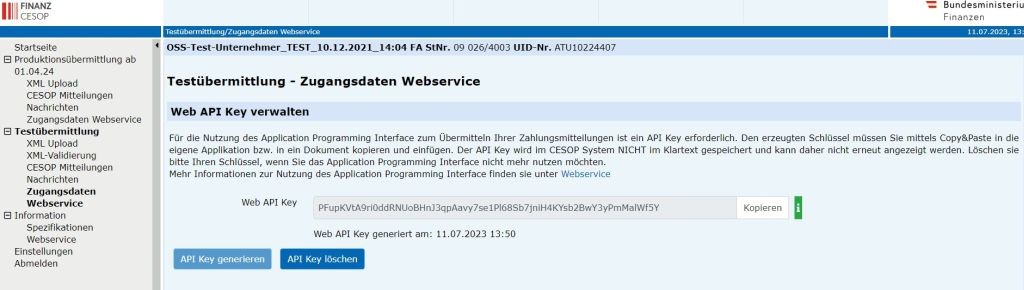

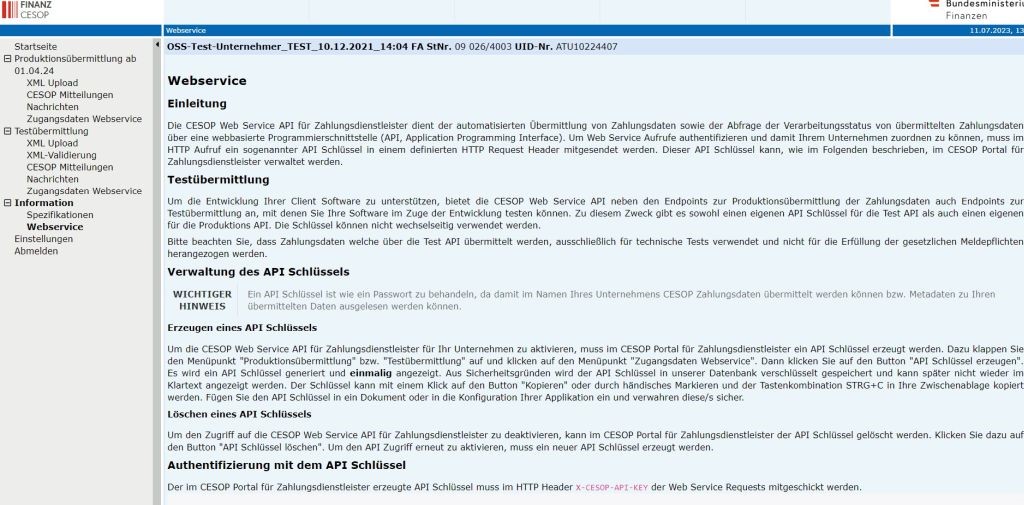

Access data web service

"Access data web service" is available for both the test and production environment. You will need an API key to use the "Application Programming Interface" to submit your payment data. The API key can be generated there for both, the test and production environment.

Information

Under this section you will find information on how to access the CESOP specifications and how to set up the web service.

Notification service

The e-mail address of the person or department responsible for the transmission can be entered under „Einstellungen“ (settings) in order to be able to use the notification service in CESOP (information about transmission messages, maintenance windows, etc.).

Email address

For technical questions relating to the CESOP portal please contact: post.cesop@bmf.gv.at

Further information on CESOP

- Information from the European Commission on CESOP

- Guidelines for the reporting of payment data: Central Electronic System of Payment information (CESOP) (europa.eu)

- Link Technical Files (XSD User Guide CESOP Validation Module)

- Frequently Asked Questions (CESOP-FAQ): Central Electronic System of Payment information (CESOP) (europa.eu)

-

Overview of the different versions and time frames for support: Specification Overview (ZIP, 2 MB)

Legal basis

- § 18a UStG 1994 (BGBl I Nr. 106/23)

- Verordnung des Bundesministers für Finanzen über die elektronische Übermittlung von Aufzeichnungen gemäß § 18a des Umsatzsteuergesetzes 1994 (BGBl II Nr. 265/2023)

- Art. 243a to 243d Directive 2006/112/EC

- COUNCIL REGULATION (EU) 2020/283 of 18 February 2020 amending Regulation (EU) No 904/2010 as regards measures to strengthen administrative cooperation in order to combat VAT fraud

- COMMISSION IMPLEMENTING REGULATION (EU) 2022/1504 of 6 April 2022 laying down detailed rules for the application of Council Regulation (EU) No 904/2010 as regards the creation of a central electronic system of payment information (CESOP) to combat VAT fraud